ข่าวสารประเทศตลาดใหม่และอื่นๆ

.jpg)

Bank of Ghana Raises Policy Rate to 21%, While Cutting Range

13 พฤศจิกายน พ.ศ. 2557

.jpg)

Ghana’s central bank raised its main interest rate to 21 percent, while reducing the band around it, having a neutral impact on borrowing costs.

The policy rate was increased from 19 percent, while the interest-rate corridor was narrowed to 300 basis points from 500 basis points, Governor Kofi Wampah told reporters today in the capital, Accra. The rate at which the central bank lends to commercial banks remains unchanged at 24 percent, he said.

“The committee decided to maintain the current tight policy stance and at the same time realign rates in the money market within the interest-rate corridor,” Wampah said.

Five out of six economists surveyed by Bloomberg predicted the policy rate to stay unchanged, whileRazia Khan, head of Africa research at Standard Chartered Bank Plc in London, forecast an increase to 20 percent.

“Despite the hike, market interest rates don’t really change,” Khan said by phone today. The lending rate to commercial banks is maintained and for market purposes, that is more important, she said.

The central bank will continue to borrow from commercial lenders at 18 percent. The cash reserve requirement was cut by 1 percentage point to 10 percent and a “further reduction may be considered when appropriate,” Wampah said.

A 14 percent rebound in the currency against the dollar since August as the government began talks with the International Monetary Fund hasn’t yet impacted inflation. Consumer prices rose 16.9 percent in October from a year ago, up from 16.5 percent in September, the statistics office said today.

Rating Downgrade

The outlook for inflation will depend on how much funding the central bank is providing to the government to cover the budget deficit, said Khan. “If the Bank of Ghana were raising the policy interest rate but at the same time actively financing the deficit in greater quantity, that would still be an easing,” she said.

Inflation will continue to remain outside the bank’s target band of 2 percentage points around 8 percent, slowing gradually toward the band in the first half of next year, Wampah said.

“The ease in inflation over the policy horizon is contingent on significant fiscal consolidation and maintenance of the tight monetary policy stance,” he said. Without that “the inflation target could take a longer duration in excess of 12 quarters to be achieved,” he said.

The cedi was trading at 3.2250 against the dollar as of 4:23 p.m. in Accra today, taking its decline for the year to 26 percent.

Standard & Poor’s last month cut Ghana’s credit rating to B-, six levels below investment grade, concerned that authorities won’t be able to rein in the budget deficit. The IMF forecasts the shortfall will reach 9.75 percent of gross domestic product this year compared with the government’s target of 8.8 percent.

To contact the reporters on this story: Moses Mozart Dzawu in Accra at mdzawu@bloomberg.net; Pauline Bax in Accra at pbax@bloomberg.net

To contact the editors responsible for this story: Nasreen Seria at nseria@bloomberg.net Karl Maier

Cr:http://www.bloomberg.com/news/2014-11-12/bank-of-ghana-raises-policy-rate-to-21-while-cutting-range.html

Cr pic:http://upload.wikimedia.org/wikipedia/commons/1/18/Bank_of_Ghana_High_Street.jpg

-

Chinese companies invest $20B in Peru’s copper mines

13 พฤศจิกายน พ.ศ. 2557 -

Algeria signs oil deals

14 พฤศจิกายน พ.ศ. 2557 -

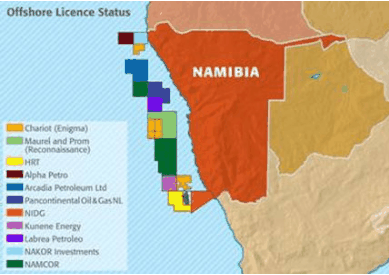

Tullow in Talks to Exit Namibia’s Kudu Gas in Investment Shift

18 พฤศจิกายน พ.ศ. 2557 -

Washington defends Egypt investment drive, despite human rights concerns

19 พฤศจิกายน พ.ศ. 2557