ข่าวสารประเทศตลาดใหม่และอื่นๆ

Ten Reasons To Invest In Sri Lanka

25 มีนาคม พ.ศ. 2558From an investor’s point of view, the case for Sri Lanka is getting strong. In the rear view mirror, yet still lurking and causing hesitation for some, are the Sri Lankan Civil War that ended in 2009 and the market bubbles that followed the war’s end through 2011. While there are risks to investing anywhere, Sri Lanka has one of the best cases for an economy with the stars aligned in its favor.

Government Stability

President Rajapaksa recently called for elections in January 2015, a full 16 months ahead of when they would be required. Under his leadership, the civil war ended in 2009, term limits for the presidency were removed in 2010, a wave of infrastructure investment has been engaged and the country’s economy has experienced a still rising peace dividend. The previous election in 2010 resulted in his party taking a little over 60% of the seats in parliament.

In provincial elections in March and September of this year, Mr. Rajapaksa’s United People’s Freedom Alliance (UPFA) party held 55% of the vote in two provinces in March and 51% in the one province in September. With no other party gaining more than 40% of the vote in any of these elections, the only question in January is how significant the UPFA majority will be in parliament after January Sri Lanka’s stock market (up 25.8% year-to-date as of October 29, 2014) is currently on-target to finish among the top 10 performing stock markets in the world this year alongside the likes of Argentina (112.8% ytd), Denmark (20.91%ytd), Dubai (40.3% ytd), India (30% ytd), Indonesia (20.4% ytd), Pakistan (24.7% ytd), Philippines (23% ytd), Qatar (38.4% ytd), Thailand (24.3%ytd) and Vietnam (21.4%; all data as of October 29, 2014).

The market has witnessed a bullish sentiment due to the prevailing low interest rate scenario. Assuming this trend continues, the market will continue its bullish trend. Next year being an election year, I would assume the market to further strengthen its position due to elections defining a clear political scenario.

Dihan Dedigama, CEO of Softlogic Stockbrokers concurs:

We feel that the Colombo Bourse will continue to be a benefactor of the low interest rate regime we have seen from the beginning of the year and will realize good returns for the next few years. With the bank loan growth expected to gradually start picking up, companies will reap the benefits of the conducive environment and should be backed by strong corporate earnings growth. Meanwhile with political stability and the country’s economy poised to grow plus 7 per cent over the next 3 years, we do not see any reason why the stock market would not perceive a steady rise.

Ceylon Asset Management has however made the boldest prediction reiterated to me last night by their Economic Advisor, Michael Preiss:

We expect 25% growth in the equity market on average per year for the next five years. If you think about it, that isn’t that much based on 7 to 8% growth in the economy annually. What people don’t realize is that on a per capita basis, Sri Lanka is twice as rich as India.

Modi’s India

Mr. Preiss went on to point out that India was an out of favor place for investments a year and a half ago but is now a popular place to invest with a high performing market since Mr. Modi was elected. There are two ways growth in India’s economy can benefit Sri Lanka:

- Based on trade relations and proximity, positive economic news for India is also positive for Sri Lanka.

- Mr. Preiss believes that as more money flows into India, investors will take the time to consider other countries in the region to invest which will net positive results for Sri Lanka.

Annual Tourism Records

The 26-year civil war was obviously bad for tourism. As a result Sri Lanka’s beaches, cultural sites, wildlife and natural beauty had multiple decades with minimal amounts of tourism. In late August this year, the one millionth tourist of this year was welcomed with greatfanfare at the airport. Tourism from people in Europe and the Middle East is steadily rising. While India for now continues to be Sri Lanka’s largest source of tourists, the biggest rise in tourism this year has been from Chinese visitors with year-over-year increases in excess of 100% on a monthly basis.

The graphs above depict tourism numbers only through the end of July 2014. Almost more important than the fact that the number of tourists is increasing is the fact that tourist arrivals are also spending more money per tourist.

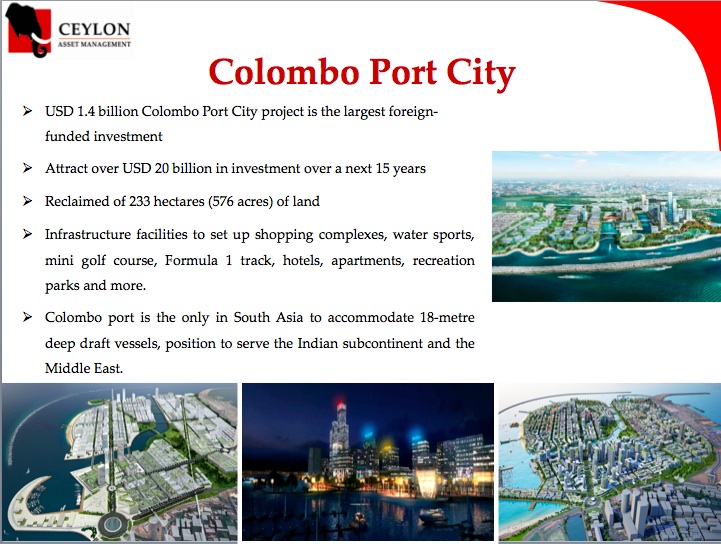

Ports And Chinese Investment

Chinese investment in Sri Lanka is aiding growth and providing a strong geopolitical and economic ally. The Chinese-led project to landfill 575 acres to create Colombo Port City adjacent to the capital of Colombo and its current port is a record-breaking private sector investment in Sri Lanka. While it may seem bold now, Sri Lanka is seeking to compete with Singapore and Dubai as a maritime center.

While other Chinese financed projects exist at other port facilities in the country, this one alone is estimated to be a $1.4 billion project. While India remains Sri Lanka’s largest trading partner, China replaced the U.S. as Sri Lanka’s second largest trading partner last year.

Internal Infrastructure

As of October 13th of this year, for the first time in 24 years, trains areconnecting the north of the country with the south. Highway and road infrastructure is also improving around the country though significant government investment. This internal infrastructure developments:

- Will improve industrial, factory and distribution network efficiency.

- Will cut down on food spoiling in transit to markets internally and externally.

- Makes tourism and investor arrivals and experiences more pleasant. For example, the new highway from the airport means my next trip from the airport to Colombo city will take about half the time and miss all the potholes.

Most importantly, infrastructure projects in Sri Lanka are not merely government talk and in planning stages, they are being executed.

There is anticipation that Sri Lanka per capita income will increase sufficiently in the next two to three years that it will become defined by the World Bank as a middle income country. Ceylon Asset Management who launched the country’s first dollar denominated bond investment fund this year thinks this is a big deal. Mr. Preiss of Ceylon Asset Management says:

When Sri Lanka moves into middle income in a couple of years, the credit rating will improve too. In 2 to 3 years, Sri Lanka could be investment grade. For fixed income investments, you make money if you invest before the asset is investment grade.

Counter-Cyclical Like Vietnam

As with Vietnam, the Central Bank of Sri Lanka is only recently lowering interest rates after raising them to reign in asset bubbles. While developed countries are still hovering near all-time low interest rates that sooner or later must rise, Sri Lanka and Vietnam are pulling back from double digit rates. Money market funds that were paying around 16% interest rates a year and a half ago are now around 9%. The price of money for business has gone down in Sri Lanka and economic growth has encouraging signs.

Real Estate On The Upswing

Ivan Robinson of Lanka Real Estate notes:

With the announcement of the draft ‘Restrictions on Alienation of Land Bill’ having been passed in Parliament on the 20th of this month, the real estate sector in Sri Lanka is now set on the right foot to attract FDI in this specific field. After two years of uncertainty in this sector we now have a clear cut law that states that the previous 100% tax due on property purchases by foreigners is no longer applicable. The new law also states that a foreigner can now hold 49% shareholding of a company that buys land, which is up from the previous 25%, the balance 51% has to be held by a Sri Lankan nominee. After 20 years, this same company then gains the same rights as a Sri Lankan individual and can buy freehold land unconditionally. Also, a foreigner can lease property for 99 years by paying a one off tax of 15% based on the value of the lease.

This new law paves the way forward for a clear and transparent solution for foreigners, individuals or corporations, to invest in the Sri Lankan Real Estate market.

Hardy Jamaldeen, manager and director of Steradian Capital since 2010 is also bullish on real estate:

Along with the current growth trajectory many opportunities are continuously arising in the SriLankan Real Estate environment. The most exciting is the foreseeable demand for long-term income producing assets. Land and buildings can bridge this gap in the form of offices, industrial estates, shopping centers, student accommodation and hotels. Structuring these assets into bite sizes that the market can absorb will be the key to its success.

Risks?

The two principal risks to Sri Lanka’s economy are a global economic downturn and the small chance that political instability is brought upon the country again by a political minority. Beyond that, there are currency exchange risks for foreign investors and there is the risk that investing somewhere else could do better. That said, all parties quoted in this article believe January’s election will lead provide an economic boost in the near-term and stable growth in the long-term.

* Our thoughts and prayers are with the families and friends of those involved in the recent flood and landslide in Central Sri Lanka this week.

Follow Jon Springer on Twitter @FrontierWriter or connect via LinkedIn.

CR :http://www.forbes.com/sites/jonspringer/2014/10/30/ten-reasons-to-invest-in-sri-lanka/

-

เอกสารประกอบการสัมมนาตลาดใหม่

25 มีนาคม พ.ศ. 2558 -

Kituyi urges Kenya to harmonise regulations on foreign investment

9 เมษายน พ.ศ. 2558 -

Pakistan offers tremendous opportunities for investment: president

16 เมษายน พ.ศ. 2558 -

Namibia: Investment Grade Will Not Become Junk Status

20 เมษายน พ.ศ. 2558