ข่าวสารประเทศตลาดใหม่และอื่นๆ

A Look At Investment Opportunities In Cameroon

16 มีนาคม พ.ศ. 2558VENTURES AFRICA – Things have continued to improve in Cameroon since the global recession in 2009 hampered its already delicate economy. The central African country endured a near-decade recession, which started in 1987 and ended in 1994. Real GDP per capital declined by more than 40 percent from $1,115 in 1987 to $627 in 1995 before improving to $1,211 in 2008 and again dropping nearly 10 percent in 2009.

Since 2009, the Cameroonian economy has continued with steady growth. The economy expanded by 4.7 percent in 2012, according to the International Monetary Fund (IMF), up from the paltry 2.0 percent in 2009. Real GDP growth is expected to hit 5.0 percent in 2013 and 5.5 percent in 2014. The IMF goes as far to estimate that the economic growth could hit 6.5 percent by 2018, albeit provided some structural reforms. Inflation remained below 3.0 percent in 2012; far better performance than its peers in the Economic Community of Central Africa States (CEMAC). Only Gabon performed better at 2.7 percent.

Economic and Political Challenges

The country may rightfully be earning the reputation as “comeback kid.” The Cameroon President Paul Biya, at the ripe age of 80, is the not expected face of this youthful country. But he continues to win election by significant margins, granted with claims of voting irregularities and fraud from opposition leaders and western governments. His age begs the question of who may guide the country over the long-term particularly with nearly 42 percent of the population under the age of 15. More than 200 political parties, according to the Economist, have arrived since multi-party politics was allowed in 1990, with many non-existent as of today.

The country maintains a long-stated goal to be an emerging market economy by 2035. But greater efforts are needed to achieve this goal. Reforming a struggling energy sector is a start. The IMF continues to pressure the government to reduce fuel subsidies. As of May 2013, fuel subsidies had grown north of 400 percent in three years. All economic indicators point to the unsustainability of this policy. Refinery capacity is slowly expanding with greater results expected after current projects are completed. But with the country only refining about 21 percent of its crude oil, the current projects with their timelines for completion provides a lack of assurance that the subsidies issue will be solved in the near term. A proposed liquefied natural gas (LNG) plant has created excitement but its actualization could take more time than expected.

Mining potential is largely untapped with opportunities available in iron, diamonds and gold among numerous others. The country has granted more than 150 to 160 exploration licenses. Yet many companies have failed to move forward on exploration. According to numerous players in the country, the Cameroon government needs to do more in the infrastructure space. Only an estimated 12 percent of Cameroon’s roads are tarred. A few decent toll roads exist largely to connect major cities. Upgrading transport, including roads and ports, is high on the government’s agenda, as indicated by consistent discourse coming from Minister of Finance Alamine Ousmane May and Minister of Economy, Planning and Regional Development Emmanuel Nganou Djoumessi. Both ministers have stood strong in the face of criticism for the high budget allocations to infrastructure, particularly for the Yaounde-Douala Highway, Bamenda Ring Road and the Menchum dam construction.

Insufficient electricity poses additional challenges. Prior electricity subsidies distort the market. Hydropower makes gains but a great amount of it goes to industrial players in the market. From the mining perspective, this is great as it ensures less downtime and delay. Yet the supply is significantly insufficient to meet long term plans for the country in the mining and industrial sectors. Others sectors accordingly faces even worse dealings with power.

Red tape may be the greatest challenge and opportunity in the sector. The recently heralded agreement between the government and Cam Iron SA, a subsidiary of the Australian mining company Sundance Resources, took practically seven years to reach completion. The deal granted Cam Iron the right to exploit a site that holds an estimated 200 billion tons of iron. The Cameroon government, who received a free 15 percent ownership stake in Cam Iron, thinks the 2.5 percent royalty fee in the agreement could amount to more than $12 billion over 25 years. According to one insider, red tape, as seen in this deal, creates a reward for both parties in the transaction. Other foreign partners struggle to navigate the inner workings of the government and walk away dismayed, he continues, but those who persevere reap unimaginable gains. Red tape may benefit mining companies but it is major bottleneck in other sectors, especially power.

Reservoir of Opportunity

It is not necessary to reiterate the natural resource potential. But it is important to note that the exploitation of these sectors could be the government’s greatest resource via revenues to investing in other sectors, specifically infrastructure. Private investment in rail and power grants potential investors access to guaranteed offtake profits and returns, as infrastructure is vital to a ready and willing to pay mining sector.

Agriculture and forestry have declined recently but still provide immense opportunity. The consumer market at home and abroad is large and growing. The country is the agricultural nucleus to the CEMAC region. About 37 million persons inhabit the six member states (Congo Brazzaville, Chad, Central African Republic, Equatorial Guinea, Gabon, and Cameroon). Neighboring Nigeria provides access to more than another 160 million additional persons. The country is home to fertile land and a favorable climate. More than 65 percent of the country’s land is arable, and it is blessed with nearly eight months of rainfall. Perhaps, improved processing and technological upgrades could push the country into the upper ranks of production on continent.

The country possesses a vast array of cash crops, including cotton, bananas and peanuts. Cameroon is the world’s fifth largest cocoa grower. Increased processing of the cocoa and coffee, including packaging and branding, could transform the sector and bring more value to producers. Palm oil and oil seed processing provides vast opportunity for feed production and oil-based products that every neighboring country is anxious to purchase.

Rubber generates north of $40 million through export. Yet it is still at its infancy stage for potential. Progressing tire production on the continent, specifically in Cameroon, could robustly alter the African and Cameroonian tire industry and increase value onshore. Low quality second-hand tires dominate many sub-Saharan African markets. It is not a secret – but rather an easily spoken truth – that most used tires are effectively dumped into Africa after topping their legal use limit in Europe. Import duties further thwarts efficiency in the industry across the continent.

The spending power of Cameroonians has grown significantly during the past few years and also created infinite opportunity for fast consumer goods. Local economists generally speak of a “puissance collective”, referring to a spending power several economists estimate to be approaching $1.2 trillion. Such figures remain hard to verify but the import of French luxuries and the figures put forth by local businesses indicate that there is ten times more truth than fiction to the story.

Manufacturing of personal care products, provided an ability to manage power deficits, offers great returns. The sector is expected to grow more than 33 percent over the next 5 years. Some companies demonstrate clear opportunities to double profits in in less than three years. Local brands, including Biopharma and Nouvelle Parfumerie Gandour, continue to make gains in market share against international brands, such as Unilever and L’Oreal. An emergence of new supermarkets offers great off-take opportunities for most locally produced products, including home products and food & beverages. Local soft drink D’jino is quite popular even against stiff competition from Coca-Cola brands.

Financing the Growth

Cameroon’s financial system is still quite underdeveloped. Access to financial services, including financial advisory services, is generally limited to large foreign or foreign-connected companies operating in the mining and energy sectors. Local companies, specifically small and medium-sized enterprises (SMEs), struggle to access cash. Loans with reasonable interest rates are rare for all-sized companies in the market.

The banking sector is highly concentrated with foreign banks leading the pack. Foreign banks achieve 20 percent-plus returns but could do more. Domestic banks, due to a lack of management expertise and capital, can struggle periodically to break even. Lack of capital and risk management hampers the sector’s overall ability to back more companies and bank more citizens.

Non-performance on loans has grown in recent years. Bank operators have responded by further limiting the availability of credit. Almost two-thirds of the population cites access to finance as a constraint to business. Major players, including Ecobank and fairly new BGFI Bank Cameroon, cite capital constraints and lack of quality bankable projects and companies for growing the sector.

Greater participation by private investors in the banking sector could relieve pressure on the overall economy. It is an easier way, in the eyes of some investors, to gain access to Cameroon’s emerging economy. But propping up the banking sector cannot be a replacement for greater private capital involvement. Financing companies through direct participation – debt or equity – and expertise is what is most needed in the country.

A new investment code – enacted in April 2013 – introduces new tax incentives, eliminates minimum investment requirement and incentivizes export and value add opportunities in the countries through numerous exemptions on VAT and duties. The greater freedom in moving currency, unlike those provided in many other African countries, that is available in Cameroon will help unleash the business entrepreneurism that exists in the country.

As a gateway and centerpiece to the CEMAC region, Cameroon is surely on the ‘comeback’ trail. But with annual inward FDI at 1.42 percent of GDP in 2011, the country still has a way to go. Cameroon can only hope that foreign investors make a ‘comeback’ in the country as the good times return.

CR:http://www.ventures-africa.com/2013/10/trade-investment-finance-cameroon/

-

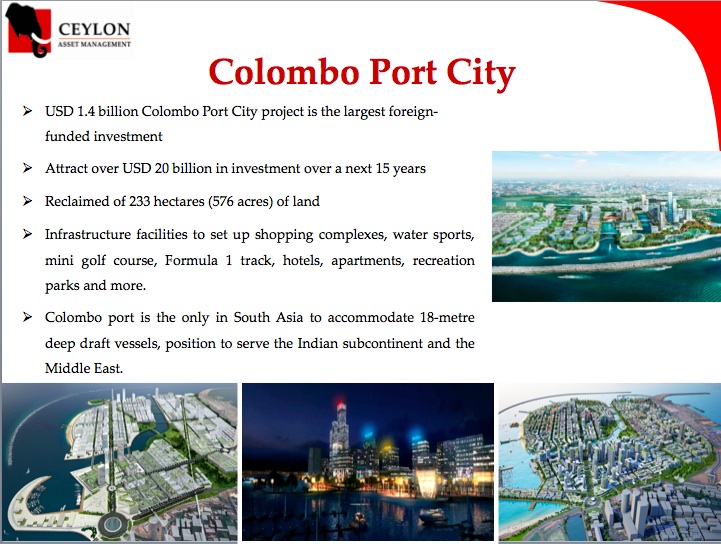

Ten Reasons To Invest In Sri Lanka

25 มีนาคม พ.ศ. 2558 -

เอกสารประกอบการสัมมนาตลาดใหม่

25 มีนาคม พ.ศ. 2558 -

Kituyi urges Kenya to harmonise regulations on foreign investment

9 เมษายน พ.ศ. 2558 -

Pakistan offers tremendous opportunities for investment: president

16 เมษายน พ.ศ. 2558