ข่าวสารกลุ่มประเทศอาเซียน

Japanese Investors shift Investment to Indonesia

14 พฤศจิกายน พ.ศ. 2557

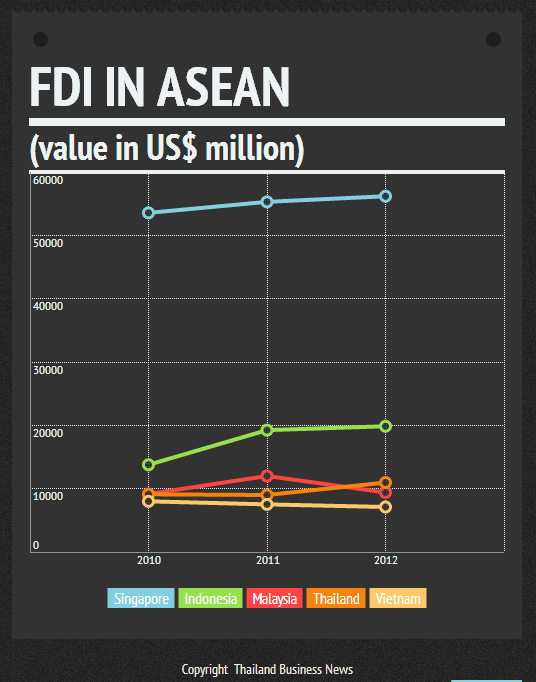

Indonesia has become an increasingly important investment hub for foreign companies, especially from Japan, although various issues in the fields of bureaucracy, legal uncertainty and corruption remain a major concern, an international investment consultancy has said.

Kroll, the global leader in risk mitigation and response, said Japanese foreign direct investment (FDI), which accounted for 16.4 percent of market share in early 2014, had continued to grow from year to year.

In 2013, Indonesia overtook Thailand to become the second-highest recipient of Japanese FDI in ASEAN, Kroll said in a report on the potential and challenges in Indonesia on FDI and mergers and acquisitions (M&A) markets, released on Tuesday.

Top Five Largest Investors in Indonesia First Half 2014:

| Country | Investment Value |

| Singapore | USD $3.4 billion |

| Japan | USD $1.5 billion |

| Malaysia | USD $0.7 billion |

| USA | USD $0.5 billion |

| South Korea | USD $0.7 billion |

According to data from the Indonesia Investment Coordinating Board (BKPM), total investment realization in Indonesia grew 16.4 percent (year-on-year) in the second quarter of 2014 to IDR 116.2 trillion (USD $10.0 billion), the highest ever quarterly investment result and thus proved that Indonesia’s legislative and presidential elections in 2014 were no reason to postpone direct investments. Foreign direct investment (FDI) was recorded at IDR 78.0 trillion (USD $6.7 billion), while domestic direct investment (DDI) was IDR 38.2 trillion (USD $3.3 billion).

“In terms of M&A, Indonesia remains favorable in Southeast Asia,” the report noted, adding that last year, Indonesia had achieved a new record for deal value, reaching a high of just over US$2 billion."

Indonesia has also attracted major investors from elsewhere.

Growing interest from foreign companies indicates Indonesia remains one of the world’s major investment destinations.

Analysts hope the new government will use the momentum to further attract foreign investors to help spur the country’s economic growth amid the decline in the global economy.

Agustinus Prasetyantoko, chief economist of state-run Bank Tabungan Negara (BTN), told The Jakarta Post that FDI would help Indonesia fix the deficit in its trade balance due to the country’s dependency on the import of raw materials.

“We need to push FDI for upstream industries as well as manufacturers that are able to create products with added value, instead of just exporting raw materials,” he said.

The Investment Coordinating Board (BKPM) reported total FDI realization in the third quarter grew 16.9 percent year-on-year to reach Rp 78.3 trillion ($6.4 billion). Total realized investments are expected to reach Rp 456 trillion this year, a 15 percent increase on last year. As of September, the country had realized Rp 342 trillion of investments.

FDI is regarded as a key feature of economic growth in the country

Investments in Indonesia account for 30 percent of gross domestic product (GDP) — the second-largest growth driver after consumer spending — as well as to support the balance of payments, which is under pressure from the current-account deficit.

| 2011 |

2012 | 2013 | ||||||||||

| Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | |

| Domestic Investment | 14.1 | 18.9 | 19.0 | 24.0 | 19.7 | 20.8 | 25.2 | 27.5 | 27.5 | 33.1 | 33.5 | 34.1 |

| Foreign Direct Investment | 39.5 | 43.1 | 46.5 | 46.2 | 51.5 | 56.1 | 56.6 | 65.5 | 65.5 | 66.7 | 67.0 | 71.2 |

| Total Investment |

53.6 | 62.0 | 65.5 | 70.2 | 71.2 | 76.9 | 81.8 | 83.3 | 93.0 | 99.8 | 100.5 | 105.3 |

Source: Indonesia Investment Coordinating Board (BKPM)

Out of a population of 237 million, more than 28 million Indonesians currently live below the poverty line and approximately half of all households remain clustered around the national poverty line set at 200,262 rupiahs per month ($16.6).

To achieve longer term goals such as lifting growth above 6 percent and reducing inequality, deeper structural reforms such as fuel subsidy reform and more infrastructure investment are crucial and would help share more broadly prosperity. In the absence of policy measures to support investment and productivity growth, the risks of a more structural deterioration in growth will mount.

Read more at http://www.thailand-business-news.com/news/featured/49392-indonesia-key-investment-hub-japan.html#8VQTrlRd9OmeWOgW.99

Cr:http://www.thailand-business-news.com/news/featured/49392-indonesia-key-investment-hub-japan.html

-

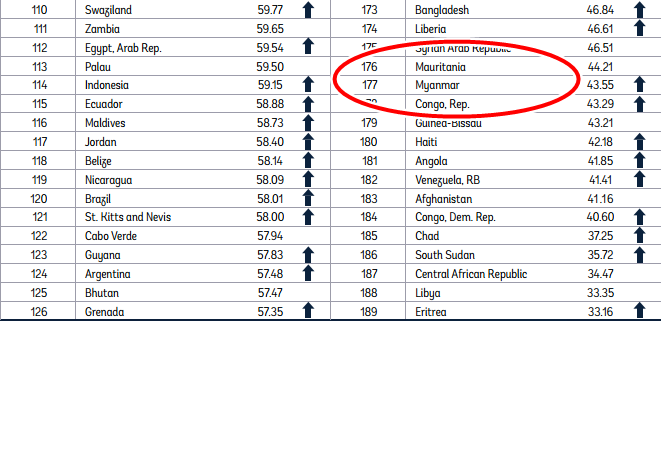

Myanmar ranks 177th, near bottom of Doing Business report

17 พฤศจิกายน พ.ศ. 2557 -

อินโดนีเซียพร้อมลงทุนเพิ่มในเมียนมาร์

18 พฤศจิกายน พ.ศ. 2557 -

การลงทุน AEC เพื่อรองรับการเปิดประชาคมเศรษฐกิจอาเซียน (AEC) ในปี 2558

19 พฤศจิกายน พ.ศ. 2557 -

เตรียมพร้อมก่อนลงทุนในสิงคโปร์

20 พฤศจิกายน พ.ศ. 2557