ข่าวสารกลุ่มประเทศอาเซียน

Indofood hopes to tap into wider ASEAN market

4 มิถุนายน พ.ศ. 2557Publicly-listed food producer PT Indofood Sukses Makmur says that it will continue expanding its investments overseas, especially to combat tightening competition ahead of the Association of Southeast Asian Nations (ASEAN) Economic Community.

Indofood CEO Anthoni Salim told reporters in a press conference on Friday that his company would keep looking for opportunities to expand abroad, after the company acquired shares in Roxas, the biggest sugar producer in the Philippines.

Anthoni declined to provide further details on the company’s future overseas investments, but said that the company would primarily focus on the Asian market. “We will continue to focus on Asia, as the world’s leading market. We will not stop penetrating into the Asian market as long as it keeps growing,” he said.

“Roxas, for example, functions not only as a complement to our revenue but also helps us prepare to tap into the wider ASEAN market once the ASEAN Economic Community [officially] kicks off next year.”

By having investments abroad, he said that Indofood could secure potential markets ahead of Southeast Asia’s free trade agreement in 2015.

Indofood has formed joint ventures in Brazil, China, the Philippines and Japan in the last few years.

The acquisition of 34 percent of Roxas shares was carried out by a joint venture called FP Natural Resources Limited (FPNRL) for about Rp 658 billion (US$57.66million).

FPNRL was established last November by Indofood’s agribusiness subsidiary Indofood Agri Resources (IndoAgri) and Hong Kong-based investment and holding company First Pacific Company Limited, which owns majority shares in In- dofood, with 30 percent ownership controlled by IndoAgri and the remaining 70 percent by First Pacific.

Singapore-listed IndoAgri carried out a $17.4 million investment in its joint venture with First Pacific, Reuters reported. Indofood has also acquired a 63.5 percent stake in Singapore-listed China Minzhong Food Corporation Limited, which began to be consolidated in Indofood’s financial report in September last year.

IndoAgri, through a subsidiary, also purchased a 50 percent stake in Brazil-based cultivation and sugarcane processing company Companhia Mineira de Acucar e Alcool Participacoes early last year. This acquisition cost IndoAgri around $66.6 million.

Anthoni said that while overseas markets were among its main objectives in its expansion, the acquisitions of the Brazilian and Singaporean firms were also expected to help the company advance the domestic agribusiness industry.

“Brazil is the world’s largest sugar producer with average sugar output standing at about 13 to 14 percent per plant, compared to Indonesia’s average output of around 7 to 10 percent. Minzhong, meanwhile, operates in industrial farming, converting local farms to industrial farms,” he said.

“We may acquire their technology and know-how to advance our own local agribusiness industry.”

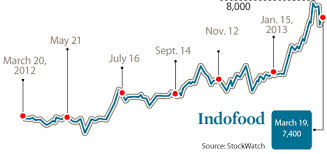

Indofood, mostly known for its noodle products, aims for 10 to 20 percent growth in revenues this year, helped by its foreign expansion and growth in almost all its business sectors.

The company’s sales stood at Rp 57.73 trillion in 2013, up 15 percent from Rp 50.2 trillion a year ago. The food giant is also targeting capital expenditure (capex) of Rp 9.6 trillion — or an increase of 60 percent compared to Rp 6 trillion last year.

Indofood corporate secretary and investor relations Werianty Setiawan said the company would source the capex from its internal cash.

She explained that about 27 percent of the total capex would be disbursed for the company’s consumer brand product subsidiary Indofood CBP Sukses Makmur, 18 percent for its flour division Bogasari, 32 percent for its agribusiness division, about 20 percent for its industrial farming business line and the rest for distribution.

หมวดของข่าว : ลงทุนต่างประเทศ , ลงทุนอาเซียน , ข้อมูลการลงทุน

-

Samsung expands VN business

4 มิถุนายน พ.ศ. 2557 -

รัฐบาลจะเพิ่มการใช้จ่ายโครงสร้างพื้นฐาน รัฐมนตรีกล่าว

6 มิถุนายน พ.ศ. 2557